Our Co-Founder and Chief Risk Officer, Igor Zaks, was recently interviewed on Trade Finance Insider:

40Seas is a one-year old technology driven financial services platform promising to offer small to medium sized importers and exporters new ways to access working capital. With offices in New York, Toronto, Shenzhen and Tel Aviv, and the backing of several financial partners, 40Seas employs an impressive team of former finance, engineering, and technology experts. Given the number of FinTechs having made similar promises, and the recent closing of several of them, TradeFinance Insider was eager to learn exactly how 40Seas is successfully differentiating itself from the rest of that pack and why its gaining impressive traction with clients and partners. Fortunately, we have the privilege of going straight to the source and interviewing one its co-founders and Chief Risk Officer – Igor Zaks, CFA, a widely known and well regarded finance and tech pioneer and innovator.

TFInsider: 40Seas’ solutions target small to medium size enterprises (SMEs). What’s behind this strategy and can SME’s working capital challenges be addressed differently by 40Seas?

40Seas: Most of the market is focused on two methods of funding, Approved Payables Financing, and traditional factoring. Approved Payables is a buyer-centric model which is typical for large businesses purchasing from smaller suppliers, where the structure accounts for dilutions and other risks and financers need to mostly account for the buyer’s credit risk. Traditional factoring models are also relevant for larger businesses. Neither model is suitable for trade between SME buyers and suppliers, which make up a massive portion of global trade. 40Seas’ digital trade finance platform is focused on empowering SMEs, leveraging new technology to provide them with services typically reserved for large companies.

TFInsider: How is 40seas in real terms different from all the other SME targeting working capital finance platforms? e.g. Taulia, Tradeshift, etc. What are its key differentiators?

40Seas: 40Seas is a truly two-sided platform, serving both buyers and sellers, providing both standalone and embedded services through a fully digital and automated experience. We leverage new technology such as machine learning, AI, and open banking to allow both buyers and sellers to access features on the 40Seas platform with minimal manual intervention and no setup costs.

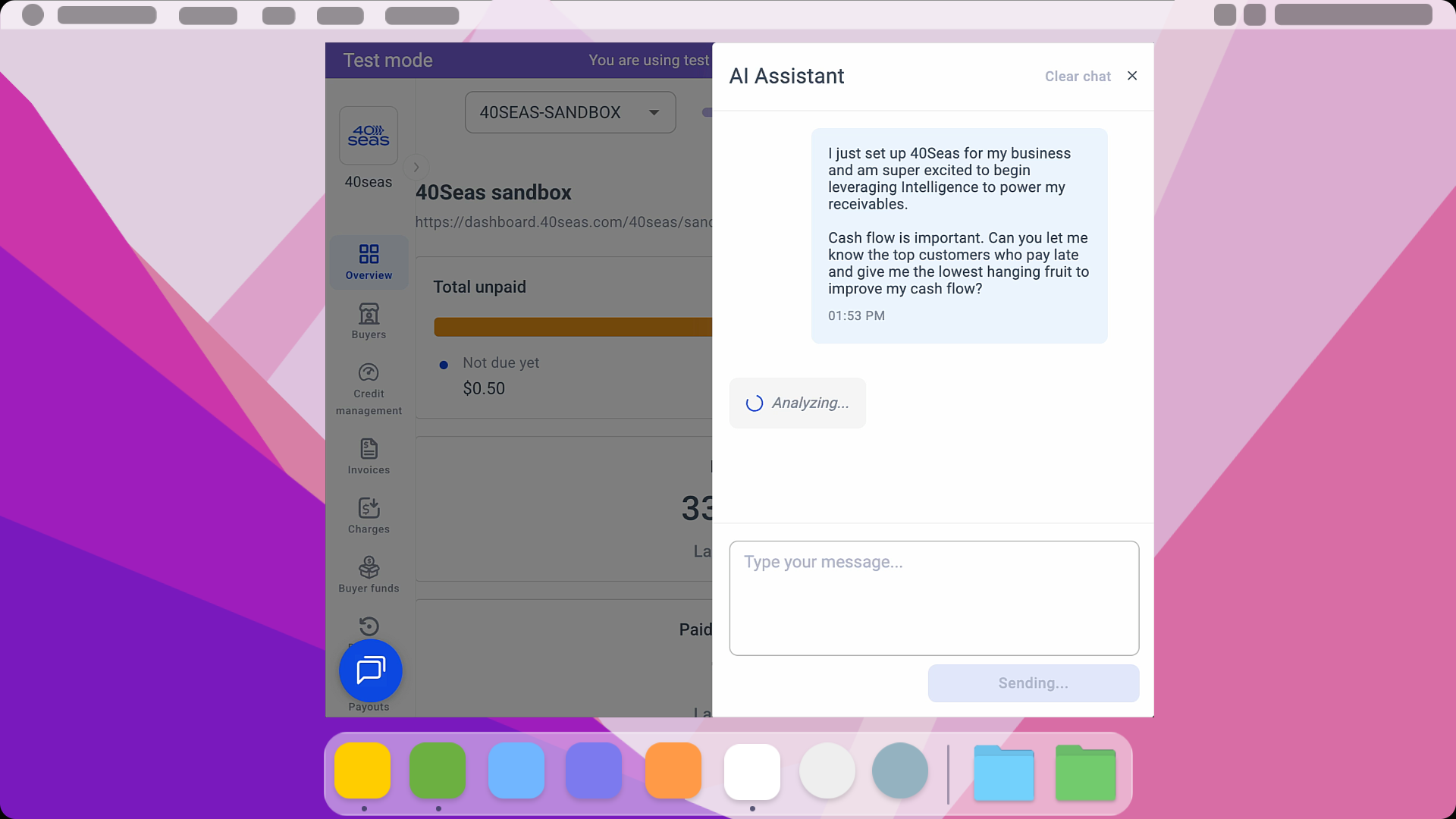

TFInsider: What role does AI play in 40Seas’ solutions.

40Seas: We use AI in multiple ways, in both marketing and risk functions. One of the critical applications allows to classification of transaction data and building the information in a way that will enable easy interpretation. Today, humans are still better than AI in making sensible decisions on limited information, but AI is so much better at dealing with massive amounts of data and extracting it in a human-digestible format.

TFInsider: How exactly does 40Seas’ use of technology provide an improvement over existing solutions? Better credit decisions? Lower financing charges - fees, interest?

40Seas: We offer better credit decisions based on contemporary underwriting techniques and utilizing all available data. Our costs are fully transparent (no hidden fees) and are flexible depending on the timing supplier needs. And we offer unprecedented efficiency in the platform operations with both portal and API integration for both buyers and sellers.

TFInsider: How does 40Seas credit and compliance check your buyers? With financial statements, audited, not audited, payment history, new tech?

40Seas: We use multiple external sources in our decisions. We also utilize open banking (and AI-based software to analyze these data), as well as open accounting through API connections. We also use payment history, logistics information, and other available data to ensure we are making efficient and responsible credit decisions.

TFInsider: Does 40Seas use trade credit insurance?

40Seas: Yes, we work closely with a major insurer (Allianz Trade). We think credit insurance is essential as a risk mitigation tool and one of the layers of credit risk assessment/management. However, we use additional checks and do not rely just on insurance. We do our own checks (empowered by both technology and experience) and can decide to either be more conservative than the insurer, or take uninsured risk, based on our own internal data and credit models.

TFInsider: How do you market new clients, suppliers or buyers? Social media? Client visits?

40Seas: We use all of it, plus multiple partnerships. We have a strong on-the-ground team in China and New York and several affiliates in other countries.

.svg)