This week we announced details around our $111 million fundraise, including a $100m credit facility with our partner ZIM to modernize SME cross-border trade financing. The funding round, led by Team8 with participation from ZIM, represents the first step in our journey to close the $1.7 trillion trade finance gap and deliver a much more efficient and cost-effective framework for SME cross-border trade.

Given the far-from-favorable macroeconomic environment, SMEs, now more than ever, need swift access to financing to have the best chance of survival and keep the wheels in motion. In truth, the deck has been stacked against SMEs for some time, and a leveling of the playing field in terms of capital availability is long overdue. This is at the heart of the 40Seas mission.

Solving a Critical Trade Finance Challenge

For me, launching 40Seas has been 25 years in the making. As a young boy, I spent many summers working alongside my father, who owned a retail store that sold clothes imported from China and India. This was an amazing personal introduction to the exciting world of cross-border trade, and I learned so much from my father, not least the broad scope of challenges confronting importers.

I recall my dad being exhausted from many sleepless nights, most notably when he needed to finance a new purchase order via a Letter of Credit (LC). I have vivid memories of him arguing with bankers over rates, filling out endless reams of paperwork, and nagging suppliers (and their banks) to provide approvals for each step in the LC process. Greater payment flexibility would have made the world of difference to my father, helping him bridge the financial gap between selling his goods to customers and paying his suppliers. To this day, the difficulties my father encountered remain commonplace for large swathes of SMEs.

In contrast to the tech-led transformations that have driven efficiencies across many other industries, the trade financing landscape has remained depressingly static — it has failed to evolve with the needs of SMEs operating in today’s hyper-competitive, digital environment. As evidenced by my father’s experience, accessing capital has been a longstanding industry pain point for SMEs, who are 7 times more likely to be denied trade financing than multinational companies, according to the WTO. In today’s unstable and fragmented supply chain landscape, difficulties accessing finance are exacerbating pressures on SMEs. These companies need absolute clarity around capital availability in order to make informed decisions around inventory management and to plan for the future with a sense of conviction. Yet even amidst a perfect storm of supply chain challenges, SMEs continue to absorb a higher portion of global cross-border trade volume — currently standing at 43% according to the OECD.

Historically speaking, a host of issues have undercut SME cross-border trading, especially for importers and exporters operating in different banking jurisdictions. They often face delays when it comes to securing the financing they need to pay suppliers or cover manufacturing costs — further impeding cash flow and inventory management. Moreover, letters of credit still require coordination among multiple stakeholders, and they are accompanied by drawn out bureaucratic processes with little-to-no transparency for business customers. Beyond all this, getting overseas suppliers to agree to net payment terms is undermined by a lack of trust between importers and exporters, as well as fluctuations in currency valuations and varied costs of capital.

40Seas: Charting the Way Forward

At 40Seas, we want to drive a literal sea change in how companies access finance, and make life easier for importers and exporters — the cornerstones of global commerce. I guess you could say 40Seas is somewhat of a ‘second generation’ platform, one that takes the learnings from my father’s import business, and provides an innovative solution that helps SMEs overcome payment-related barriers to cross-border trade while freeing up working capital.

Between myself and my co-founders, we have more than 60 years of combined experience in cross-border payments, logistics, and trade financing. With bases established in Tel Aviv, New York City, Toronto and Shenzhen, we’ve assembled a fantastic global team of talented engineers to help us advance our mission. Together, we are all driven to modernize SME cross-border trade financing and accelerate the digital transformation of the supply chain space.

Our B2B Import Now, Pay Later solution enables exporters to get paid immediately upon shipment so they can get a head start on their next production cycle, while providing importers with deferred payment options so they can grow their business without tying up available lines of credit. It can also be used by freight forwarders and sourcing agencies to increase cross-border trade volumes, generate new revenue streams, and digitize B2B payment processes while helping businesses streamline communications around order tracking.

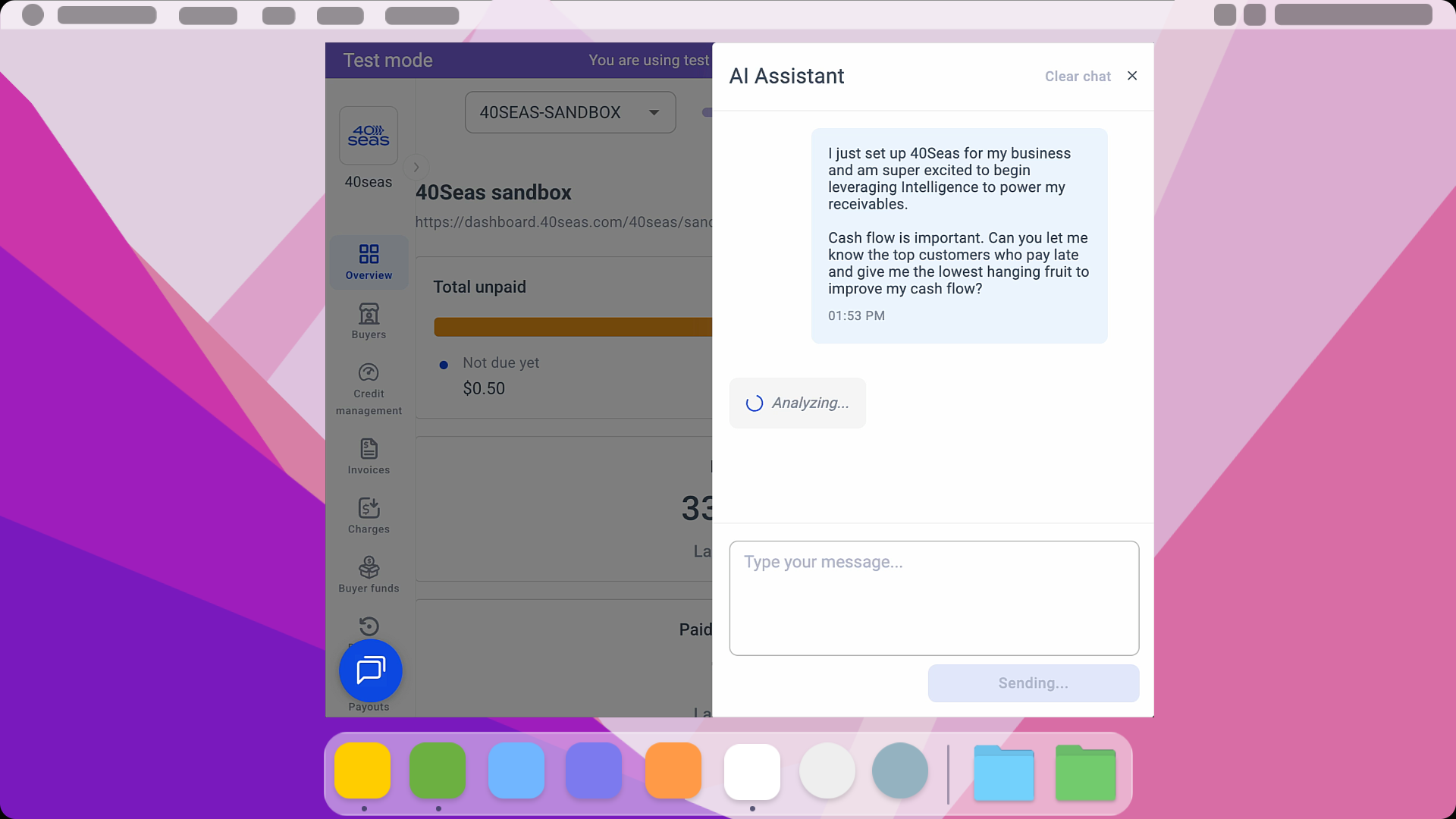

Leveraging data-driven technology to automate decision-making processes and verify creditworthiness, our solution can be seamlessly embedded into checkout portals to improve business flow and deliver more convenience to customers. Since going live with our soft launch in October 2022, we have already onboarded dozens of SMEs, and we are on track to finance millions of dollars in the coming months.

Finally, I’d like to thank Team8 for leading our seed funding round and providing crucial support in getting 40Seas off the ground. We’re also grateful to our amazing partner ZIM for joining the seed round and providing a $100 million credit facility to exporters and importers in their ecosystem. As a multi-billion dollar market leader, they have provided a major stamp of validation and confidence in our solution. We look forward to working closely with Team8 and ZIM to further develop a best-in-class framework for cross-border trade financing that is truly tailored to the needs of SMEs around the globe.

.svg)