Are we entering the trustless innovation era? At every turn, there seems to be a groundswell of momentum powering systems and protocols that operate without reliance on centralized intermediaries, improving transparency, security, and integrity across industries.

Trust, or perhaps distrust, has played a pivotal role in shaping the dynamics of the legacy logistics landscape, leading to complex, fragmented systems and excessive paperwork. A general lack of transparency and barriers to communication have hindered efficiencies for the sector – exacerbating trust issues between importers and exporters. With record level congestion at ports, unprecedented shipping delays and ongoing price volatility, the stakes couldn’t be higher for ecosystem players. Given this perfect storm of challenges confronting the logistics space, long standing importer-exporter tension is being amplified, making it extremely difficult for them to agree on flexible payment terms. Importers are wary of goods not arriving in perfect condition, while exporters fear the worst in that they won’t receive payment for said goods. Amidst a precarious global economy, both sides of the transaction naturally want to safeguard operations, drive profitability, and execute better decision making, and will, if necessary, take a hard line on trade terms.

At a time when tech-led innovations are revolutionising processes across the industry spectrum, the logistics landscape could benefit greatly from a wholesale embrace of flexible payment solutions. Flexibility in the payments arena can help resolve the aforementioned trust issues between importers and exporters, ensuring immediate payment upon shipment and mitigating concerns about delayed payments or non-payments.

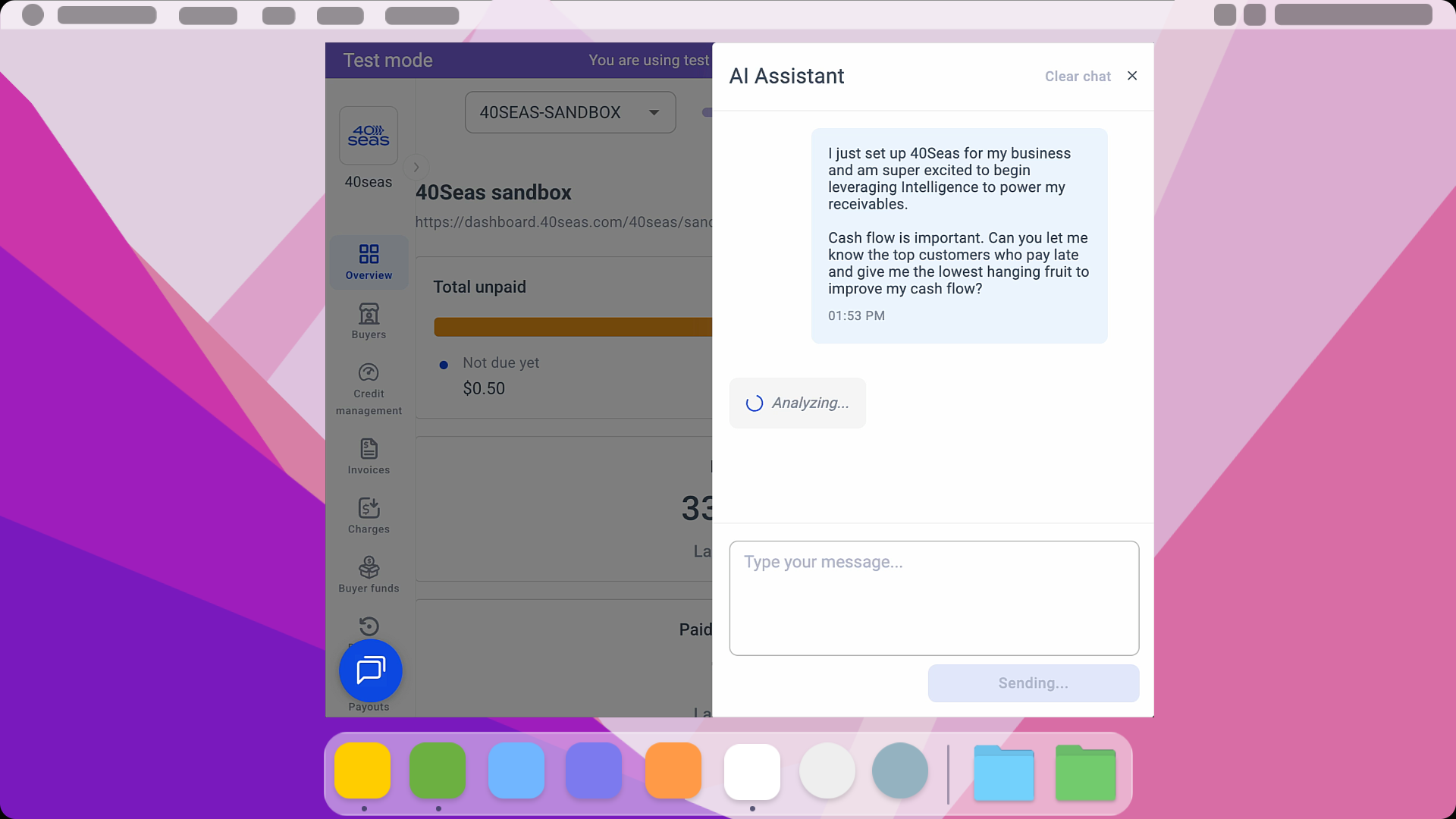

At 40Seas, this concept of trust resolution is at the heart of our platform. Acknowledging this widening trust chasm between importers and exporters, we’re helping ecosystem players bridge the financial gap between selling goods to customers and paying suppliers. Our B2B ‘Order Now, Pay Later’ solution enables exporters to get paid immediately upon shipment so they can get a head start on their next production cycle, while providing importers with deferred payment options so they can grow their business without tying up available lines of credit. We’re also helping freight forwarders and sourcing agencies to increase cross-border trade volumes, generate new revenue streams, and digitize B2B payment processes. We’re also facilitating much more streamlined communications around order tracking. So how does this make life easier for importers and exporters?

Well, for importers, flexible payment options address the age-old issue of cash flow management. When dealing with global suppliers, importers often face a significant time gap between paying for goods and selling them to end customers, undermining their ability to plan ahead with a real sense of conviction. Through Order Now, Pay later arrangements, importers can access the necessary goods upfront while deferring payment until after the products are sold, mitigating cash flow constraints and enabling more strategic decision-making and resource allocations.

Moreover, flexible payment options alleviate the burden of complex and expensive financing processes, such as Letters of Credit (LCs). The traditional LC process involves multiple intermediaries, reams of paperwork, and time-consuming negotiation of terms, resulting in delays and increased costs. Deploying more flexible payment solutions would reduce bureaucracy and administrative overheads, facilitating a smoother and quicker transaction process for all stakeholders.

For exporters, receiving payment immediately upon shipment can significantly improve liquidity and reduce credit risk. By ensuring prompt receipt of funds, exporters can reinvest capital into their businesses, expand production capacity, or explore new market opportunities. This enhanced liquidity boosts the exporter's ability to innovate and scale at pace, or in line with market demand.

So, aside from the practical benefits that flexible payment options provide to both importers and exporters operating in today’s frantic global economy, one of the most significant value adds and offshoots is fortified trust and stronger relationships between key industry stakeholders. By offering favorable payment terms, importers can demonstrate genuine commitment and reliability, fostering long-term partnerships. In turn, exporters feel more secure in their business dealings, leading to improved collaboration and repeat business. Flexible payment options also empower businesses in emerging markets and Small and Medium-sized Enterprises (SMEs) that may have limited access to traditional financing. By providing greater payment flexibility, these solutions level the playing field, enabling smaller players to participate more effectively in global trade and expand their commercial horizons considerably.

.png)

.svg)